Maximize Your Health and Wealth: The Ultimate Guide to Health Savings Accounts (HSAs)

Ever bumped into a colleague at the water cooler and heard them talk about a Health Savings Account (HSA)? And then wondered, “What’s that?” Well, you’re not alone. As employers increasingly shift towards offering HSAs as part of their benefits package, many of us are left scratching our heads, trying to figure out if it’s a boon or a bane. Let’s dive deep into what an HSA is, why it might be your golden ticket to a healthier financial future, and how it’s different from that standard health plan you’re familiar with. Grab your notepad, because Health Savings 101 is about to begin!

HSA (Health Savings Account) 101: What’s the Buzz About?

A health savings account, or HSA, is a retirement or savings account built to pay for your future health costs. Like an IRA, the idea is to put money away into the HSA and let it grow before taking it back out.

The health savings account is the trifecta of tax savings. Money that goes into an HSA is pre-tax money, like a 401k. This money can either come directly out of your paycheck so it skips taxes, or you can contribute the money on your own and deduct it from your taxes. Once the money is in the account, it becomes invested through the investment options that you select. The money will continue to grow tax-free and can be taken out tax-free. A health savings account is the only type of account that has this type of tax savings.

Unlike a flexible spending account, or FSA, an HSA never expires. An FSA must be used by the end of the year, or the contributions will be lost. Not only will an HSA roll over from year-to-year, but if you left your employer, then you will take the health savings account with you.

Unlike most retirement plans, you can withdraw from a health savings account at any time. There is no penalty or taxes if you withdraw the money earlier than retirement.

An HSA must have a high-deductible health plan with it. You cannot open an HSA without one, and not all high-deductible health plans will allow a health savings account.

Decoding Health Insurance: The Nitty-Gritty Details

A high-deductible health plan means that the amount of money you must pay out for healthcare services is higher than the standard plan. The upside is that the higher the deductible in the plan, the lower the monthly premium tends to be. It becomes a tradeoff, paying more when you do have healthcare expenses versus paying more every month. This can be bad because you can get hit with a bigger bill once it comes time to pay for healthcare. On the other hand, money spent on a monthly premium is simply money gone.

Health plans can structure deductibles in a couple of ways. If you are an individual, you will have to meet the individual deductible before the insurance steps in and helps to pay. If you are a family and you are paying to cover that family, the insurance can have individual or aggregate deductibles. The individual deductible means that each person in the family has their own deductible that they must meet. The aggregate deductible means anyone in the family can meet the deductible for the entire family. Under this method, you could spend the deductible money on yourself and then not have to pay a deductible when your spouse has healthcare expenses.

After the deductible, we get coinsurance. The insurance company is not going to pick up the total cost once a deductible has been paid. They will pay for a part of it. The part that they do pay for is called coinsurance. Coinsurance is usually stated as a percentage, and it is the percentage that you will pay once the deductible has been paid.

For example, if your deductible is $1,000 and your coinsurance is 20%, you will pay $1,100 of a $1,500 health bill. You take your total bill minus the $1,000 deductible, and you are left with $500. Of that $500, you will pay 20%, or $100, of it. This brings your total bill to $1,100. Once you have hit your deductible for the year, you won’t have to pay it again until the next year. It does not restart for every health bill; it restarts every year. Once it has been used, healthcare expenses become cheaper for you for the rest of the year.

If you have already used your deductible for the year and you are debating on getting a medical procedure done in December or January, it would be cheaper to have it done in December.

The next feature of a healthcare plan that you must know is the out-of-pocket limit. The out-of-pocket limit is the maximum amount you can spend on healthcare in a given year, not including monthly premiums.

Once you have reached your out-of-pocket limit, the healthcare company will take over 100% of the expenses.

You had a procedure that costs $20,000, you have a $1,300 deductible, 20% coinsurance, and an out-of-pocket maximum of $4,400. The most you would pay for this procedure is $4,400, plus any monthly premium charges.

You first subtract the deductible from the total amount because that must be paid first. $20,000 minus $1,300 gives you $18,700 left in charges. With the remaining charges, you figure out the amount you would pay with the coinsurance. 20% of $18,700 is $3,740. Your total charges are $1,300 plus $3,740 for a total bill of $5,040. This amount is more than your out-of-pocket maximum, so the total amount you would pay is $4,400. The insurance company would cover the remaining $640. Any more healthcare expenses for the rest of the year would also be covered in full by the healthcare provider.

Mastering Your HSA: Tips to Make the Most of It

The first step in maximizing your HSA is the need to find a quality custodian to hold the account. Your employer will have their own custodian that they use to manage the health savings account, but you are not limited to that custodian. Any money that is added to the account from your paycheck will need to go into the account your employer set up, but any money that you add can be sent to your own custodian.

Each custodian comes with their own fee structure, which includes annual fees and setup fees, along with their own investment options. Investment options can be limited to a few certain funds, or be very wide and self-directed. If you do not like the custodian provided by your employer, don’t use that one, find your own, and make your own contributions.

A quality, up-to-date breakdown of the top HSA custodians can be found at 20 Something Finance.

While finding the right custodian is crucial, there’s more to maximizing a health savings account.

Once you have a custodian, either provided by your employer or one you found yourself, you need to fund it. The contribution limits for your health savings account depend on the type of healthcare plan that you are on at your work. If you are on a single plan where it just covers you, then your 2023 contribution limit is $3,850. If, however, you are on the family plan at work, your 2023 contribution limit is $7,750. These contribution limits are not aggregated with any other limits. So, if you invest in a Traditional IRA or Roth IRA, it doesn’t limit how much you can put into an HSA.

The idea behind a health savings account is to make these contributions, have them grow over the years, and then cash them out in retirement. If you have a funded HSA, you can save your medical receipts over the years and submit them in retirement to get all the money back. This allows your contributions and earnings to get exponential growth over the years.

You cannot save or cash in any medical receipts from before you had a health savings account. This will also require you to pay out-of-pocket for your medical expenses up until that point. Again, you will have to pay your deductible and coinsurance up to the maximum out-of-pocket expense.

Being able to take advantage of the compounding of returns in an HSA is another great reason to have an emergency fund. If you do not have an emergency fund or find yourself tight on cash, it is still okay to use your health savings account immediately.

Once you no longer have a high-deductible health plan or you move onto Medicare, you can no longer contribute to an HSA. You can still use, move, and get the money out of your health savings account, but you will no longer be able to contribute.

Choosing Wisely: Comparing Your Company’s Health Plans

A lot of employers are now offering high-deductible plans with health savings accounts. Overall, if they can pass higher healthcare costs onto the employee, it will be cheaper for the employer. When looking through these benefits, sometimes the employer can really make the high-deductible plan attractive.

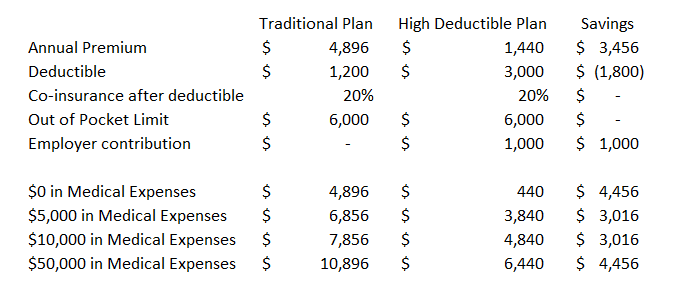

Here is a comparison of the traditional plan and the high-deductible plan offered by the client’s employer. The first thing you should start with is the annual premium and how much is going to come out of your paycheck to pay for your health plan. No matter what happens, this is a sunk cost that must be paid. It does not count towards the out-of-pocket limit. High-deductible plans should always be cheaper in this aspect. In this case, they went from $204 a paycheck ($408 a month) to $60 a paycheck ($120 a month). Right off the bat, that is a savings of $3,456.

With a high-deductible health plan, you are expected to lose money in the deductible portion. In this case, the deductible increased by $1,800. Not a huge deal, but it is more money that will need to be spent out-of-pocket before insurance kicks in. When comparing all this information, make sure you compare the single-to-single plan and the family-to-family plan.

The coinsurance and out-of-pocket maximum are the same in both plans. This is not always the case, but as I said, some employers really gear the high-deductible plan to be a no-brainer.

To further sweeten the deal, the employer is going to contribute $1,000 annually into the health savings account. This benefit is not received through the traditional plan.

Once you have all your numbers figured out, it is best to run a few scenarios to make sure which plan is better. We like to know which plan comes out on top in the best-case scenario, worst-case scenario, and somewhere in-between.

The best-case scenario would be $0 in medical expenses. In this case, the only money you are spending will be the annual premium amount. Clearly, the high-deductible plan is going to win here. Not only is the premium a lot cheaper, but they also kick $1,000 annually into the plan.

The worst-case scenario would be $50,000. This is enough money that the annual out-of-pocket limit has been reached. For the traditional plan, the total cost would simply be the out-of-pocket limit plus the annual premium amount. In this case, $10,896 would be the total cost. For a high-deductible plan, the total cost is $6,440. This is the out-of-pocket limit, plus the annual premium, minus the employer contribution.

We threw in a few other scenarios just to make sure that we have the right plan in place. As you can see, no matter what happens, good or bad, the high-deductible plan comes out on top. Now, this isn’t always the case. Some employers are not as generous with their high-deductible plans as this one.

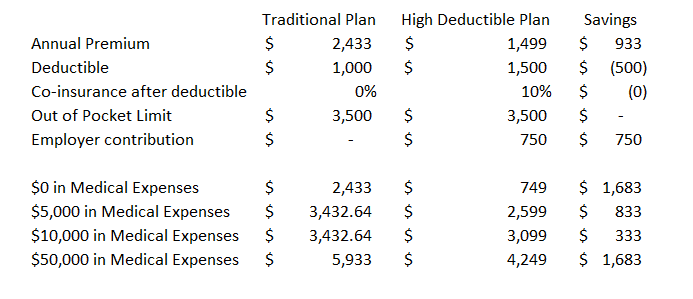

Here is a good example of a plan that wasn’t built as strong. The traditional plan didn’t cost as much, so the savings in the high-deductible plan weren’t as predominant. There was some relief in that the deductible limit wasn’t a giant increase and the employer did fund the HSA annually. The interesting thing to note with this plan is the addition of the coinsurance when you switch to the high-deductible plan.

Looking at our scenarios, we can still see savings across the board, making the high-deductible plan the way to go.

Steps to Maximize Your Health Savings Account (HSA)

- Educate Yourself:

- Understand the basic concept of HSAs.

- Differentiate between HSAs, FSAs, and traditional retirement plans.

- Know the tax advantages associated with an HSA.

- Deep Dive into Health Insurance Mechanics:

- Understand the high-deductible health plan (HDHP).

- Grasp the concept of deductibles and how they work for individuals vs. families.

- Learn about coinsurance, and calculate potential health bill scenarios.

- Familiarize yourself with the out-of-pocket limit and how it impacts your annual healthcare costs.

- Optimize Your HSA:

- Research and select a high-quality HSA custodian.

- Review fees, investment options, and services.

- Compare your employer’s chosen custodian with other options in the market.

- Keep track of yearly contribution limits based on your healthcare plan.

- Save your medical receipts; consider creating a dedicated folder or digital storage system.

- If possible, avoid immediate withdrawals and let your HSA funds grow.

- Analyze Your Company’s Health Plans:

- Compare traditional health plans to high-deductible ones.

- Factor in annual premiums, deductibles, coinsurance, out-of-pocket limits, and any employer contributions.

- Use different medical expense scenarios to predict yearly costs for each plan type.

- Make an informed decision based on your analysis and individual/family needs.

- Stay Updated:

- Regularly review any changes to HSA regulations and contribution limits.

- Periodically reassess your health plan, especially during your company’s enrollment period.

- Consider consulting with a financial advisor or benefits specialist for personalized advice.

- Final Thoughts:

- Periodically review your benefits and determine if the high-deductible plan still meets your needs.

- Harness the triple-tax advantages of HSAs.

- If you’re consistently funding your HSA and letting your contributions grow, consider seeking investment advice for maximizing returns.

- Stay Active & Healthy:

- While managing financial health is essential, remember to prioritize your physical and mental well-being. Regular check-ups and a balanced lifestyle can lead to reduced medical expenses in the future!

Conclusion

Navigating the world of employer benefits can be like trying to find your way in a maze. But here’s the takeaway: if a high-deductible plan paired with a Health Savings Account (HSA) is on the table, give it a serious look. Many employers design these plans to be enticing, and more often than not, they’re worth your consideration. Remember, HSAs are like the triple-crown winners in the financial world – they offer unmatched tax benefits at every stage. So, before you make any decisions, weigh the pros and cons, consider your healthcare needs, and maybe even chat with a financial advisor. Your future self, enjoying a stress-free retirement, might just thank you!

Glossary

Health Savings Account (HSA): A tax-advantaged savings account designed for individuals with high-deductible health plans to pay for out-of-pocket medical expenses.

High-Deductible Health Plan (HDHP): A health insurance plan with a higher deductible than a traditional insurance plan. Qualifying for an HDHP is a requirement for opening an HSA.

Deductible: The amount you must pay out-of-pocket for healthcare expenses before your insurance plan begins to pay.

Coinsurance: Once the deductible is met, coinsurance represents the percentage of medical costs you’re responsible for, with the rest covered by your insurance.

Out-of-Pocket Limit: The maximum amount you’d need to pay for covered healthcare services in a single year. After reaching this limit, the insurance pays 100% of the costs.

HSA Custodian: An institution (often a bank or financial services company) that oversees and administers the HSA.

Tax Advantaged: Refers to any type of investment, account, or savings plan that is either exempt from taxation, tax-deferred, or offers other types of tax benefits.

Flexible Spending Account (FSA): Another type of tax-advantaged account, but unlike an HSA, FSAs are owned by the employer and have a “use-it-or-lose-it” provision. FSAs allow employees to set aside pre-tax dollars for healthcare or dependent care expenses.

Contribution Limit: The maximum amount of money that can be deposited into an HSA during a calendar year.

Employer Contribution: An amount of money the employer deposits into the employee’s HSA. This counts towards the annual contribution limit.

Premium: The amount paid, often monthly, for health insurance coverage.

Benefits Specialist: A human resources professional who specializes in understanding and managing employee benefits, including health insurance.

Triple-Tax Advantages: Refers to the tax benefits of HSAs which include: contributions being tax-deductible, investments growing tax-free, and withdrawals for eligible expenses being tax-free.